Abstract

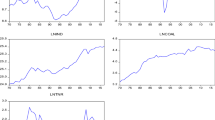

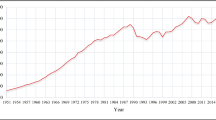

To boost the stability of economic and financial aspects along with the apprehensions for sustainability, it is important to promote the development of clean energy stocks around the globe. In the current research, the researchers have examined the impact of oil prices, coal prices, natural gas prices, and gold prices on clean energy stock using the autoregressive distribution lag (ARDL) approach from the year 2011 to the year 2020. The result of daily data analysis specifies that in the long as well as in the short run, gold prices, oil prices, and coal prices have a positive and significant effect on clean energy stock. On the other side, natural gas prices in the long as well as in the short run have a negative and significant effect on clean energy stock. So, the empirical analysis of our study is of interest to investors at an institutional level who aim at detecting the risk associated with the clean energy market through proper financial modeling. Besides, this study opens up a new domain to sustain financial as well as economic prospects by protecting the environment through clean energy stock as the investment in clean energy stocks results in producing a substantial effect on the economy and the environment as well.

Similar content being viewed by others

Data availability

The data of this manuscript was collected from different websites, i.e., World Gold Council, S&P, Federal Reserve Economic Data, and investing.com.

References

Abraham S, & Ramanathan HN (2020). Asset price interrelationship: real estate, gold, and stocks. SCMS J Indian Manag 64.

Acaravci A, Kandir S (2012) Natural gas prices and stock prices: evidence from EU-15 Countries. Econ Model 29:1646–1654. https://doi.org/10.1016/j.econmod.2012.05.006

Ahmad W (2017) On the dynamic dependence and investment performance of crude oil and clean energy stocks. Res Int Bus Financ 42:376–389

Ahmad W, Sadorsky P, Sharma A (2018) Optimal hedge ratios for clean energy equities. Econ Model 72:278–295

Ahmed WM (2018) On the interdependence of natural gas and stock markets under structural breaks. Q Rev Econ Finance 67:149–161

Ahuja D, Tatsutani M (2009) Sustainable energy for developing countries. Sapiens 2(1)

Alam MS, Apergis N, Paramati SR, Fang J (2020) The impacts of R&D investment and stock markets on clean-energy consumption and CO2 emissions in OECD economies. Int J Financ Econ

Ali R, Mangla IU, Rehman RU, Xue W, Naseem MA, Ahmad MI (2020) Exchange rate, gold price, and stock market nexus: a quantile regression approach. Risks 8(3):86

Al-Mulali U, Ozturk I (2016) The investigation of environmental Kuznets curve hypothesis in the advanced economies: the role of energy prices. Renew Sust Energ Rev 54:1622–1631

Anser MK, Usman M, Godil DI, Shabbir MS, Sharif A, Tabash MI, & Lopez LB (2021). Does globalization affect the green economy and environment? The relationship between energy consumption, carbon dioxide emissions, and economic growth. Environ Sci Pollut Res 1-14.

Arouri MEH, Lahiani A, Nguyen DK (2015) World gold prices and stock returns in China: insights for hedging and diversification strategies. Econ Model 44:273–282

Baur DG, Lucey BM (2010) Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ Rev 45(2):217–229

Baur DG, McDermott TK (2010) Is gold a safe haven? International evidence. J Bank Financ 34(8):1886–1898

Brehm P (2019) Natural gas prices, electric generation investment, and greenhouse gas emissions. Resour Energy Econ 58:101106

British Petroleum (2016) Statistical review of world energy June 2016. http://www.bp.com/en/global/corporate/energy-economics/statisticalreview-of-world-energy.html. Accessed 04 Jul 2021

Chakravorty, U., Magné, B., & Moreaux, M. (2003). From coal to clean energy: hotelling with a limit on the stock of externalities.

Chkili W (2016) Dynamic correlations and hedging effectiveness between gold and stock markets: evidence for BRICS countries. Res Int Bus Financ 38:22–34

Ciner C, Gurdgiev C, Lucey BM (2013) Hedges and safe havens: an examination of stocks, bonds, gold, oil and exchange rates. Int Rev Financ Anal 29:202–211

Dutta A (2017) Oil price uncertainty and clean energy stock returns: new evidence from crude oil volatility index. J Clean Prod 164:1157–1166

EIA. (2018). EIA - Annual Energy Outlook 2018”. U.S. Energy Information Administration, Office of Energy Analysis U.S. Department of Energy (Vol. DC 20585): Washington.

Elie B, Naji J, Dutta A, Uddin GS (2019) Gold and crude oil as safe-haven assets for clean energy stock indices: Blended copulas approach. Energy 178:544–553

Ferdaus J, Appiah BK, Majumder SC, Martial AAA (2020) A panel dynamic analysis on energy consumption, energy prices and economic growth in next 11 countries. Int J Energy Econ Policy 10(6):87–99

Ferrer R, Shahzad SJH, López R, Jareño F (2018) Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ 76:1–20. https://doi.org/10.1016/j.eneco.2018.09.022

Fuentes F, Herrera R (2020) Dynamics of connectedness in clean energy stocks. Energies 13(14):3705

Gao A, Sun M, Han D, Shen C (2020) Multiresolution analysis of information flows om international carbon trading market to the clean energy stock market. J Renew Sustain Energy 12(5):055901

Gilmore CG, McManus GM, Sharma R, Tezel A (2009) The dynamics of gold prices, gold mining stock prices and stock market prices comovements. Res Appl Econ 1(1):1–19

Godil DI, Sharif A, Rafique S, Jermsittiparsert K (2020) The asymmetric effect of tourism, financial development, and globalization on ecological footprint in Turkey. Environ Sci Pollut Res 27(32):40109–40120. https://doi.org/10.1007/s11356-020-09937-0

Godil DI, Sarwat S, Quddoos MU, Akhtar MH (2019) A comparative study on the behavior of Islamic and conventional stocks in the presence of oil price, gold price, and financial risk factors: evidence from Dow Jones Indices. Rev Appl Manag Soc Sci 2(2):117–128

Gong B (2020). Different behaviors in natural gas production between national and private oil companies: economics-driven or environment-driven? Shale Energy Revolution (pp. 131-149): Springer.

Gu F, Wang J, Guo J, Fan Y (2020) How the supply and demand of steam coal affect the investment in clean energy industry? Evidence from China. Res Policy 69:101788

Gupta A, & Dalei NN (2020). Energy, environment and globalization: an interface Energy, Environment and Globalization (pp. 1-14): Springer.

Gyamfi BA, Ozturk I, Bein MA, Bekun FV (2021) An investigation into the anthropogenic effect of biomass energy utilization and economic sustainability on environmental degradation in E7 economies. Biofuels Bioprod Biorefin 15(3):840–851

Harahap LA, Lipikorn R, & Kitamoto A (2020). Nikkei Stock Market Price Index prediction using machine learning. Paper presented at the Journal of Physics: Conference Series

He X, Takiguchi T, Nakajima T, & Hamori S (2020). Spillover effects between energies, gold, and stock: the United States versus China. Energy Environ 0958305X20907081.

Hillier D, Draper P, Faff R (2006) Do precious metals shine? An investment perspective. Financ Anal J 62(2):98–106

Holladay JS, LaRiviere J (2017) The impact of cheap natural gas on marginal emissions from electricity generation and implications for energy policy. J Environ Econ Manag 85:205–227

Hoque ME, Low S-W, Zaidi MAS (2020) The effects of oil and gas risk factors on malaysian oil and gas stock returns: do they vary? Energies 13(15):3901

Hussain M, Ye Z, Usman M, Mir GM, Usman A, Abbas Rizvi SK (2020) Re-investigation of the resource curse hypothesis: the role of political institutions and energy prices in BRIC countries. Res Policy 69:101833

International Energy Agency (2015). Energy and climate change: world energy outlook special report: International Energy Agency.

Jaiswal B, Manoj S (2015) An analysis of gold price variation and its impact on commodity market in India. Arth Prabandh: A Journal of Economics and Management 4(7):59–79

Jiang C, Wu Y-F, Li X-L, Li X (2020) Time-frequency connectedness between coal market prices, new energy stock prices and CO2 emissions trading prices in China. Sustainability 12(7):2823

Jordan S, & Philips AQ (2018). DYNARDL: stata module to dynamically simulate autoregressive distributed lag (ARDL) models.

Ju K, Su B, Zhou D, Wu J (2017) Does energy-price regulation benefit China’s economy and environment? Evidence from energy-price distortions. Energy Policy 105:108–119

Kanamura T (2020) A model of price correlations between clean energy indices and energy commodities. J Sustain Finance Invest:1–41

Khalfaoui R, Boutahar M, Boubaker H (2015) Analyzing volatility spillovers and hedging between oil and stock markets: evidence from wavelet analysis. Energy Econ 49:540–549

Khan SAR, Godil DI, Quddoos MU, Yu Z, Akhtar MH, & Liang Z (2021). Investigating the nexus between energy, economic growth, and environmental quality: a road map for the sustainable development. Sustain Dev 1-12.

Kilian L (2009) Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99(3):1053–1069

Kocaarslan B, Soytas U (2019) Asymmetric pass-through between oil prices and the stock prices of clean energy firms: new evidence from a nonlinear analysis. Energy Rep 5:117–125

Knittel CR, Metaxoglou K, & Trindade A (2015). Natural gas prices and coal displacement: evidence from electricity markets (0898-2937).

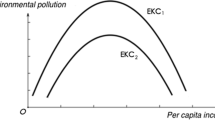

Koondhar MA, Shahbaz M, Memon KA, Ozturk I, Kong R (2021) A visualization review analysis of the last two decades for environmental Kuznets curve “EKC” based on co-citation analysis theory and pathfinder network scaling algorithms. Environ Sci Pollut Res 28(13):16690–16706

Kumar S, Managi S, Matsuda A (2012) Stock prices of clean energy firms, oil and carbon markets: a vector autoregressive analysis. Energy Econ 34(1):215–226

Kumar S, Pradhan AK, Tiwari AK, Kang SH (2019) Correlations and volatility spillovers between oil, natural gas, and stock prices in India. Res Policy 62:282–291

Lin B, Chen Y (2019) Dynamic linkages and spillover effects between CET market, coal market and stock market of new energy companies: a case of Beijing CET market in China. Energy 172:1198–1210. https://doi.org/10.1016/j.energy.2019.02.029

Linn J, Muehlenbachs L (2018) The heterogeneous impacts of low natural gas prices on consumers and the environment. J Environ Econ Manag 89:1–28

Lv X, Dong X, & Dong W (2019). Oil prices and stock prices of clean energy: new evidence from Chinese subsectoral data. Emerg Mark Finance Trade 1-15.

Mahmood MT, Shahab S, Hafeez M (2020) Energy capacity, industrial production, and the environment: an empirical analysis from Pakistan. Environ Sci Pollut Res 27(5):4830–4839

Managi S, Okimoto T (2013) Does the price of oil interact with clean energy prices in the stock market? Jpn World Econ 27:1–9

Morema K, Bonga-Bonga L (2020) The impact of oil and gold price fluctuations on the South African equity market: volatility spillovers and financial policy implications. Res Policy 68:101740–101740. https://doi.org/10.1016/j.resourpol.2020.101740

Naeem MA, Peng Z, Suleman MT, Nepal R, Shahzad SJH (2020) Time and frequency connectedness among oil shocks, electricity and clean energy markets. Energy Econ 91:104914.f

Nasreen S, Tiwari AK, Eizaguirre JC, Wohar ME (2020) Dynamic connectedness between oil prices and stock returns of clean energy and technology companies. J Clean Prod 260:121015

Niesenbaum RA (2020) Artisanal gold mining in Las juntas de Abangares, Costa Rica: Approaches and barriers to achieving sustainability objectives. Environ Sci Pol 114:470–477

Mukhamediyev B, Spankulova L (2020) The impact of innovation, knowledge spillovers and oil prices on economic growth of the regions of Kazakhstan. Int J Energy Econ Policy 10(4):78–84

Mukherjee P, Bardhan S (2020) Assessing the Impact of COVID-19 on interactions among stock, gold and oil prices in India. TradeDev Rev 13(1):33–56

Murshed M, Chadni MH, Ferdaus J (2020) Does ICT trade facilitate renewable energy transition and environmental sustainability? Evidence from Bangladesh, India, Pakistan, Sri Lanka, Nepal and Maldives. Energy Ecol Environ 5(6):470–495

Murshed M, Tanha MM (2020) Oil price shocks and renewable energy transition: empirical evidence from net oil-importing South Asian economies. Energy Ecol Environ 6:183–203. https://doi.org/10.1007/s40974-020-00168-0

Oberndorfer U (2009) Energy prices, volatility, and the stock market: evidence from the Eurozone. Energy Policy 37(12):5787–5795

ÓhAiseadha C, Quinn G, Connolly R, Connolly M, Soon W (2020) Energy and climate policy—an evaluation of global climate change expenditure 2011–2018. Energies 13(18):4839

Omer AM (2008) Energy, environment and sustainable development. Renew Sust Energ Rev 12(9):2265–2300

Ordu BM, Soytaş U (2016) The relationship between energy commodity prices and electricity and market index performances: evidence from an emerging market. Emerg Mark Financ Trade 52(9):2149–2164

Ozturk I (2013) Energy dependency and energy security: the role of energy efficiency and renewable energy sources. Pak Dev Rev 52:309–330

Ozturk I (2016) Biofuel, sustainability, and forest indicators' nexus in the panel generalized method of moments estimation: evidence from 12 developed and developing countries. Biofuels Bioprod Biorefin 10(2):150–163

Ozturk I, Acaravci A (2010) CO2 emissions, energy consumption and economic growth in Turkey. Renew Sust Energ Rev 14(9):3220–3225. https://doi.org/10.1016/j.rser.2010.07.005

Panwar N, Kaushik S, Kothari S (2011) Role of renewable energy sources in environmental protection: a review. Renew Sust Energ Rev 15(3):1513–1524

Pham L (2019) Do all clean energy stocks respond homogeneously to oil price? Energy Econ 81:355–379

Ramos SB, Veiga H (2011) Risk factors in oil and gas industry returns: international evidence. Energy Econ 33(3):525–542

Raza N, Shahzad SJH, Tiwari AK, Shahbaz M (2016) Asymmetric impact of gold, oil prices and their volatilities on stock prices of emerging markets. Res Policy 49:290–301

Reboredo JC, Rivera-Castro MA, Ugolini A (2017) Wavelet-based test of co-movement and causality between oil and renewable energy stock prices. Energy Econ 61:241–252

Reboredo JC, Ugolini A (2018) The impact of energy prices on clean energy stock prices. A multivariate quantile dependence approach. Energy Econ 76:136–152

Saeed T, Bouri E, Alsulami H (2020) Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Econ 96:105017

Sadorsky P (2012) Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ 34(1):248–255

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Shahzad SJH, Bouri E, Kayani GM, Nasir RM, Kristoufek L (2020) Are clean energy stocks efficient? Asymmetric multifractal scaling behaviour. Physica A: Stat Mech Appl 565:124519

Sheikh UA, Asad M, Ahmed Z, Mukhtar U (2020) Asymmetrical relationship between oil prices, gold prices, exchange rate, and stock prices during global financial crisis 2008: Evidence from Pakistan. Cogent Econ Finance 8(1):1757802

Sun C, Ding D, Fang X, Zhang H, Li J (2019) How do fossil energy prices affect the stock prices of new energy companies? Evidence from Divisia energy price index in China's market. Energy 169:637–645. https://doi.org/10.1016/j.energy.2018.12.032

Syahri A, Robiyanto R (2020) The correlation of gold, exchange rate, and stock market on Covid-19 pandemic period. J Keuangan dan Perbankan 24(3):350–362

Thomas S, Rosenow J (2020) Drivers of increasing energy consumption in Europe and policy implications. Energy Policy 137:111108

Troster V, Shahbaz M, & Macedo DN (2020). Optimal forecast models for clean energy stock returns Econometrics of Green Energy Handbook (pp. 89-109): Springer.

Tursoy T, Faisal F (2018) The impact of gold and crude oil prices on stock market in Turkey: empirical evidences from ARDL bounds test and combined cointegration. Res Policy 55:49–54. https://doi.org/10.1016/j.resourpol.2017.10.014

World Nuclear Association. (2020). Renewable Energy and Electricity. (https://www.world-nuclear.org/information-library/energy-and-the-environment/renewable-energy-and-electricity.aspx).

Xie W, Sheng P, Guo X (2015) Coal, oil, or clean energy: which contributes most to the low energy efficiency in China? Util Policy 35:67–71

Yong JY, Yusliza M, Ramayah T, Fawehinmi O (2019) Nexus between green intellectual capital and green human resource management. J Clean Prod 215:364–374

You C, Kwon H, Kim J (2020) Economic, environmental, and social impacts of the hydrogen supply system combining wind power and natural gas. Int J Hydrog Energy 45(46):24159–24173

Zhang H, Cai G, Yang D (2020) The impact of oil price shocks on clean energy stocks: fresh evidence from multi-scale perspective. Energy 196:117099

Zhang L, Godil DI, Bibi M, Khan MK, Sarwat S, Anser MK (2021) Caring for the environment: how human capital, natural resources, and economic growth interact with environmental degradation in Pakistan? A dynamic ARDL approach. Sci Total Environ 774:145553

Zhao C, Luo K (2018) Household consumption of coal and related sulfur, arsenic, fluorine and mercury emissions in China. Energy Policy 112:221–232. https://doi.org/10.1016/j.enpol.2017.10.021

Zhao X (2020) Do the stock returns of clean energy corporations respond to oil price shocks and policy uncertainty? J Econ Struct 9(1):1–16

Zia S, Ur Rahman M, Noor MH, Khan MK, Bibi M, Godil DI, ..., Anser MK (2021). Striving towards environmental sustainability: how natural resources, human capital, financial development, and economic growth interact with ecological footprint in China. Environ Sci Pollut Res 1-15.

Author information

Authors and Affiliations

Contributions

Munaza Bibi: original draft

Muhammad Kamran Khan: formal analysis

Sobia Shujaat: revision, writing draft

Danish Iqbal Godil: writing—original draft, conceptualization

Arshian Sharif: supervision

Muhammad Khalid Anser: supervision

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bibi, M., Khan, M.K., Shujaat, S. et al. How precious metal and energy resources interact with clean energy stocks? Fresh insight from the novel ARDL technique. Environ Sci Pollut Res 29, 7424–7437 (2022). https://doi.org/10.1007/s11356-021-16262-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16262-7