Abstract

In many jurisdictions, the determination of the acceptable rate of return for the assets of a regulated utility is based partially on the Capital Asset Pricing Model (CAPM) to determine risk premia. However, the traditional estimation of CAPM can be criticized for not including considerations of reference-day risk as well as the higher moments of the rates of return. In this paper, we attempt to account for both the potential variation induced by the definition of specific reference days and the higher moments of rates of return in the estimates of Beta. This paper provides a new methodology to account for reference-day variation. We construct a set of pseudo-monthly rates of return to identify the influence of reference-day choice. These pseudo-monthly asset returns are used to estimate measures of asset systematic risk for an international panel of regulated firms. To evaluate the influence of return rate volatility we examine the errors from the estimation of the CAPM with least squares, least absolute deviation and a partially adaptive maximum likelihood specification.

Similar content being viewed by others

Notes

These models have been applied in the finance literature as well as the macroeconomics cases as demonstrated in Andreou (2016).

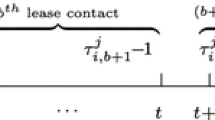

The reference day could be the middle of the month such as the 15th as well.

The algorithm used can be made more efficient with the appropriate modifications such as suggested in Gleason's (1988) BB3 method.

Only major holidays such as Christmas and New Year’s Day were added to the weekends. Asset prices from the preceding days are used for cases when there are gaps in the series.

The permutations of the month definitions are not repeated in any of the 5000 cases considered here. The distribution of dates of the simulated ending days is available from the authors on request.

All the daily asset price data, government bond rates, market indices and dividend data were obtained from Bloomberg data services.

Here, the bias we refer to can be classed as a form of a bootstrap estimate of bias as described in Efron and Tibshirani (1993).

The boxplots are defined where the upper and lower limits of the boxes are defined by the 75 and 25 percentiles, the centre line is the median and the whiskers extend to the upper and lower bounds or 1.5 times the interquartile distance whichever is smaller.

Several studies have noted that time-varying volatility is not a problem when using low-frequency data (e.g. McDonald and Xu 1995, Fong 1997, Mills and Markellos 2008). We also examine the potential influence of a GARCH process in these errors as was investigated by (Mills and Markellos, chapter 8, 2008). Although our resampling method preserves the sequence of the observations and we could include time-varying aspects in our models fit to the pseudo-months, we found no indication of the presence of these processes had any significant influence on our results.

We define significance in this case to be 2 standard deviations where the standard deviation for the skewness is given by \(\sqrt {{\raise0.7ex\hbox{$6$} \!\mathord{\left/ {\vphantom {6 N}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{$N$}}}\) and for the excess kurtosis \(\sqrt {{\raise0.7ex\hbox{${24}$} \!\mathord{\left/ {\vphantom {{24} N}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{$N$}}}\), where N is the number of observations.

We estimate the covariance of the parameter estimates to allow for heteroscedastic errors to account for the use of computed regressors in the model.

Note that these results are strongly influenced by the use of a weighted OLS approach for this estimation, where the weights are based on the variance of the mean of the bootstrap estimates.

The QMLE was obtained using the OLS estimates for α and β as starting values with restrictions on the values of .05 to 10.0 for p, -1 to 1 for λ and 0 to 1 for ϕ. The optimization was done with a Newton–Raphson method as implemented in the nlpnra routine in SAS Proc IML.

Note that these results are strongly influenced by the use of a weighted OLS approach for this estimation, where the weights are based on the variance of the mean of the bootstrap estimates.

References

Acker D, Duck N (2007) Reference-day risk and the use of monthly returns data. J Acc Audit Financ 22:527–557

Andreou E (2016) On the use of high frequency measures of volatility in MIDAS regressions. J Econom 193:367–389

Baker C, Rajaratnam K, Flint E (2016) Beta Estimates of shares on the JSE Top 40 in the context of Reference-Day Risk. Environ Syst Decis 36:126–141

Blume M (1975) Betas and their regression tendencies. J Financ 30:785–795

Buckland R, Williams J, Beecher J (2015) Risk and regulation in water utilities: a cross-country comparison of evidence from the CAPM. J Regul Econ 47:117–145

Cornell B, Dietrich J (1978) Mean-Absolute-Deviation Versus Least-Squares Regression Estimation of Beta Coefficients. J Financial Quant Anal 13:123–131

Davison A, Hinkley D, Schechtman E (1986) Efficient Bootstrap Simulation. Biometrika 73:555–566

Dimitrov V, Govindaraj S (2007) Reference-day risk: observations and extensions. J Account Audit Finance 22:559–572

Efron B, Tibshirani R (1993) An Introduction to the Bootstrap. Chapman and Hall, New York, NY

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Fong W (1997) Robust Beta estimation: Some empirical evidence. Rev Financial Econom 6:167–186

Ghysels E, Santa-Clara P, Valkanov R (2006) Predicting volitity: getting the most out of returned data sampled at different frequencies. J Econom 131:59–95

Ghysels E, Sinko A, Valkanov R (2007) MIDAS Regressions: Further Results and New Directions. Economet Rev 26:53–90

Gilbert T, Hrdlicka C, Kalodimos J, Siegel S (2014) Daily Data is Bad for Beta: Opacity and Frequency-Dependent Betas. Rev Asset Pric Stud 4:78–117

Gleason J (1988) Algorithms for Balanced Bootstrap Simulations. Am Stat 42:263–266

Gonzalez M, Rodriguez A, Stein R (2014) Adjusted Betas under reference-day risk. Eng Econ 59:79–88

Gregory A, Hua S, Tharyan R (2018) In search of Beta. Br Account Rev 50:425–441

Hansen, C., J. McDonald, and P. Theodossiou (2007), “Some Flexible Parametric Models for Partially Adaptive Estimators of Econometric Models”, economics, No 2007–7, www.economics-ejournal.org/economics/journalarticles.

Jarque C, Bera A (1980) Efficient tests of normality, homoscedasticity and series independence of regression residuals. Econ Lett 6:255–259

Künsch H (1989) The Jackknife and the Bootstrap for General Stationary Observations. Ann Stat 17:1217–1241

McDonald J, Nelson R (1989) Alternative Beta estimation for the market model using partially adaptive techniques. Commun Stat 18:4039–4058

McDonald J, Xu Y (1995) A generalization of the beta distribution with Applications. J Econom 66:133–152

McDonald J, Michelfelder R, Theodossiou P (2009) Robust Regression Estimation Methods and Intercept Bias: A Capital Asset Pricing Model Application. Multinatl Financ J 13:293–321

McDonald J, Michelfelder R, Theodossiou P (2010) Robust Estimation with flexible parametric distributions: estimation of utility stock Betas. Quant Finance 10:375–387

Mills T, Markellos R (2008) The Econometric Modelling of Financial Time Series, 3rd edn. Cambridge University Press, Cambridge, UK

Sharpe W (1971) Mean-Absolute-Deviation Characteristic Lines for Securities and Portfolios. Manage Sci 18:B1–B13

Theodossiou P (2015) Skewed generalized error distribution of financial assets and option pricing. Multinatl Financ J 19:223–266

Villadsen B, Vilbert M, Harris D, Kolbe L (2017) Risk and Return for Regulated Industries. Elsevier Science & Technology, Amsterdam

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hirschberg, J., Lye, J. Estimating risk premiums for regulated firms when accounting for reference-day variation and high-order moments of return volatility. Environ Syst Decis 41, 455–467 (2021). https://doi.org/10.1007/s10669-021-09812-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10669-021-09812-4