Abstract

Background

Within (European) healthcare systems, the predominant goal for pharmaceutical expenditure is cost containment. This is due to a general belief among healthcare policy makers that pharmaceutical expenditure—driven by high prices—will be unsustainable unless further reforms are enacted.

Objective

The aim of this paper is to provide more realistic expectations of pharmaceutical expenditure for all key stakeholder groups by estimating pharmaceutical expenditure at ‘net’ prices. We also aim to estimate any gaps developing between list and net pharmaceutical expenditure for the EU5 countries (i.e. France, Germany, Italy, Spain, and the UK).

Methods

We adjusted an established forecast of pharmaceutical expenditure for the EU5 countries, from 2017 to 2021, by reflecting discounts and rebates not previously considered, i.e. we moved from ‘list’ to ‘net’ prices, as far as data were available.

Results

We found an increasing divergence between expenditure measured at list and net prices. When the forecasts for the five countries were aggregated, the EU5 (unweighted) average historical growth (2010–2016) rate fell from 3.4% compound annual growth rate at list to 2.5% at net. For the forecast, the net growth rate was estimated at 1.5 versus 2.9% at list.

Conclusions

Our results suggest that future growth in pharmaceutical expenditure in Europe is likely to be (1) lower than previously understood from forecasts based on list prices and (2) below predicted healthcare expenditure growth in Europe and in line with long-term economic growth rates. For policy makers concerned about the sustainability of pharmaceutical expenditure, this study may provide some comfort, in that the perceived problem is not as large as expected.

Similar content being viewed by others

Pharmaceutical policy is sometimes driven by limited data. |

Our aim was to fill an important gap in the difference between list and net pharmaceutical expenditure in the EU5 and describe how that difference might evolve in the near future. |

Available data indicate that the list versus net pharmaceutical expenditure gap is significant and increasing. |

Our results suggest that pharmaceutical expenditure is under control, below predicted healthcare expenditure growth in Europe, and in line with long-term economic growth rates. |

1 Introduction

European healthcare systems are under pressure to manage rising healthcare costs associated with changing demographics, rising patient expectations, and the launch of new, premium-priced medicines (and healthcare technologies more generally) addressing areas of unmet need. A seminal paper on the drivers of healthcare costs pointed to ‘innovation’ as the major cost driver; this was considered more important than demographics [1]—bearing in mind that the analysis focused on the US healthcare market, which is significantly different from that in Europe. Within (European) healthcare systems, the predominant goal for pharmaceutical expenditure is cost containment, with a tendency to adopt a ‘silo mentality’ and separately consider expenditure on particular healthcare resources, in this case pharmaceuticals [2]. According to the most recent Organisation for Economic Co-operation and Development (OECD) data (2018), pharmaceutical expenditure accounts for between 11.4% (UK) and 19.1% (Spain) of total healthcare expenditure across the five largest European drug markets, i.e. France, Germany, Italy, Spain, and the UK (the EU5) [3]. This proportion in the EU5 has fallen slightly since 2008, largely due to both cost-containment mechanisms imposed after the global financial crash and to a wave of patent expiries [3]. However, it is worth noting the limitations in the OECD data (discussed in Sect. 4), such as excluding drugs used in inpatient settings in some countries (although Italy does include that data) and including over-the-counter products; overall, total pharmaceutical expenditure should be higher.

There is a general belief among healthcare policy makers that pharmaceutical expenditure—driven by high prices—will be unsustainable in future unless further reforms are enacted. A recent OECD initiative on access to innovative pharmaceuticals and sustainability of pharmaceutical expenditure stated that “high prices compromise patient access and put an unsustainable strain on healthcare budgets” [4, 5]. The same premise underlies the recent European Council conclusions on “strengthening the balance in the pharmaceutical systems in the European Union and its Member States” [5].

While this concern is widespread, there is a lack of agreement about what constitutes a ‘sustainable’ rate of growth for pharmaceutical expenditure and a paucity of forecasts of future growth rates upon which to inform policy making in Europe. We were unable to identify any published forecasts from governmental bodies, at either European or member state levels, that predict pharmaceutical expenditure from 2018 onwards. However, forecasting of pharmaceutical expenditure has been undertaken in some European regions (e.g. Stockholm), and horizon scanning and budgeting activities are also increasing among European countries [6,7,8]. Some forecasts are also available for orphan medicines, where the high cost per patient does not necessarily translate into issues of ‘affordability’ [9].

Forecasts are available from commercial organisations, with two different fundamental methodologies utilised. Most common are predictions based on reported sales data from pharmaceutical company financial returns, which extrapolate forward based on historical trends. These forecasts tend to be global in perspective, as many companies do not report sales data split out by region. Such forecasts are not particularly informative for European policy makers, as they do not reflect the differences in drug markets between Europe, the USA, and Asia. In addition, such forecasts may have less use if they report sales at ‘list’ prices without considering rebates, ‘basket deals’, and discounts (the latter being a common feature of sales to secondary care organisations).

The other forecast methodology is that applied by IQVIA (formerly Quintiles IMS) using its proprietary audited volume data collected from representative samples of pharmacies and hospitals globally. These data are used to provide estimates of historical pharmaceutical expenditure at the country, region, and global level and to forecast future trends in market growth [10]. The most recent (2016) IQVIA forecast for European pharmaceutical expenditure growth predicts a compound annual growth rate (CAGR) of between 1 and 4% across EU5 countries between 2016 and 2021 [5, 11].

While IQVIA data are considered robust and are used by commercial, governmental, and academic researchers, certain aspects of the methodology may affect policy makers’ interpretations of the estimates. One consideration is that IQVIA forecasts include pharmaceutical expenditure by both public (reimbursed) and private (out of pocket, private insurance) sources, whereas policy makers are primarily interested in the former. More importantly, the IQVIA methodology (described in more detail in Sect. 2) estimates historical and future expenditure using ‘list’ (also referred to ‘official’) prices (net of published discounts), which do not reflect confidential discounts and rebates (‘discounts’) provided to public healthcare systems by manufacturers, especially for new medicines used in the hospital setting (rather than dispensed by retail pharmacists) [12,13,14]. Broadly speaking, two types of discounts are most commonly applied: (1) discounts or agreements at the product level, which may be negotiated by national, regional, or local payers; (2) rebates at the industry level, whereby manufacturers retrospectively pay back money to national payers when total pharmaceutical expenditure exceeds a certain threshold. As mentioned in the following, the level of discounts for some agreements are publicly available, albeit in aggregate.

The existence of such discounts has potentially important implications for policy makers. Historical and future estimates of pharmaceutical expenditure that are based on list prices, rather than net prices, will overstate aggregate pharmaceutical expenditure and its proportion of overall healthcare expenditure. Equally, if the magnitude of discounts is changing over time, excluding these from forecasts will also affect the predicted growth rate of future pharmaceutical expenditure. Discounts may be applied differently in different countries or healthcare settings and may be driven by different mechanisms and incentives in different settings.

While many discounts are confidential (hence their exclusion from IQVIA estimates), their prevalence and importance are believed to have increased in Europe over the last decade [15]. Indeed, the use of such agreements may in part explain the decline in relative pharmaceutical expenditure observed by the OECD between 2008 and 2015—noting the caveats around OECD data as mentioned and that most discounting takes place at the hospital level, which is not included in OECD data. This is in addition to substantial savings made during this period when several standard medicines lost their patents, including atorvastatin, clopidogrel, and esomeprazole, as well as various angiotensin receptor blockers and atypical antipsychotics. The increase in the use of discounts has been driven by increasing price pressures and international reference pricing systems [16] that incentivise manufacturers to negotiate confidential agreements that do not affect list prices [15].

A factor that may influence pharmaceutical prices and level of discounts are patient access agreements that are based on achievement of a mutually agreed treatment outcome (see, for instance, Jommi [17], Adamski et al. [18], Pauwels et al. [19] and Clopes et al. [20]). Whilst these agreements may be confidential, restricted at present to certain specific treatment and health problems, and have a proportionately small impact on pharmaceutical expenditure, it is important to acknowledge that the impact could be greater if some countries increase their use of these schemes.

Against this context, the objective of this study was to estimate future pharmaceutical expenditure growth rates in France, Germany, Italy, Spain, and the UK (EU5) at net prices by adjusting the established IQVIA analysis (‘list forecast’) for discounts that are not currently incorporated (‘net forecast’). In doing so, the paper aims to provide more realistic expectations of pharmaceutical expenditure for all key stakeholder groups. Adjustments were made to the list forecast as follows:

-

Historical estimates of pharmaceutical expenditure from 2010 to 2016 (‘historical list estimate’) were adjusted to reflect discounts not previously considered (‘historical net estimate’).

-

Forecasts of future expenditure from 2017 to 2021 were re-run using the adjusted historical data to derive the net forecast.

The focus of the analysis was the EU5 countries individually and in aggregate, as they contribute appreciably to the overall expenditure of medicines in Europe. An example of the type of sensitivity analyses that could be performed is also provided (impact of biosimilars).

2 Methods

We followed a four-step approach, as depicted in Fig. 1. Our starting point (‘1’ in Fig. 1) was the IQVIA historical list estimates of pharmaceutical expenditure (2010–2016), which are the basis for the list forecasts of future expenditure (2017–2021) (‘2’ in Fig. 1). We then estimated the discounts that historically have been observed in each country and that are not included in the historical list estimates to create the historical net estimates (‘3’ in Fig. 1). Finally, we adjusted the list forecast for each country to reflect the historical net estimates to arrive at a net forecast (‘4’ in Fig. 1).

2.1 Step 1: Historical List Estimate (2010–2016)

Our starting point was IQVIA’s data and forecasts, which we revised accordingly. IQVIA MIDAS® data are volume based, tracking virtually every medicine through retail and non-retail channels, with official, non-confidential prices applied at pack level to assess value spend [11, 21]. Price data are captured at different points in the supply chain by market, e.g. pharmacy selling price, wholesaler price, ex-manufacturer price. However, country-specific mark-ups are used to reflect price at the publicly available ex-manufacturer level.

IQVIA data capture expenditure on medicines that require a prescription (labelled as Rx), as well as those that do not (non-Rx). Rx expenditure represents the majority of sales value, given the high levels of reimbursement across EU5 markets—ranging between 87% in France and 97% in the UK (IQVIA data on file). The value split between Rx and non-Rx has remained mostly stable over the last 10 years. It should be noted that we are interested in total pharmaceutical expenditure and thus do not report the expenditure on branded medicines and generics separately. However, given the future importance of biosimilars, we report the impact of some sensitivity analysis around biosimilar uptake and price competition.

2.2 Step 2: List Forecast (2017–2021)

IQVIA’s country-specific forecasts combine historical sales data, macroeconomic indicators, and expected events (e.g. new product launches) to estimate future pharmaceutical expenditure [11, 21]. First, historical volume and price data are analysed and plotted. Second, baseline projections are developed using exponential smoothing techniques to represent the extrapolation of underlying conditions. Third, events are assessed, quantified, and applied to baseline projections. Events can include major new product launches (informed by IQVIA LifeCycle R&D Focus, a global database covering more than 31,000 medicines in research or development), generic competition, and legislative/policy change (among others). Macroeconomic trends are based on econometric modelling from the Economist Intelligence Unit. For each event, the date, probability of occurrence, time to impact, and level of impact are assessed and modelled, drawing on analogue analysis (i.e. based on past experience in other therapeutic areas) and interviews with market experts.

The baseline forecast is refined and adjusted with internal expertise and insight within each country. This is supplemented with extensive primary and secondary research among all key stakeholders in the industry, including government representatives, regulatory authorities, key opinion leaders, specialists, physicians, pharmacists, pharmaceutical companies and wholesalers.

2.3 Step 3: Historical Net Estimate (2010–2016)

IQVIA data use publicly available prices. These can reflect the real cost to public payers in some cases, but further discounts also exist in many situations. As previously discussed, a range of (complex) mechanisms now impact net pharmaceutical expenditure. Step 3 was to adjust the historical list estimate to reflect these discounts and derive the historical net estimates.

Table 1 describes the most important discount mechanisms across the five countries and whether they were already accounted for within the IQVIA list forecast. These include discounts at the national level agreed between individual manufacturers (or industry collectively) and government agencies and agreements at the regional or hospital level, usually on a product basis.

At the national level, four countries have some form of national rebate, whereby a cap is set on total pharmaceutical expenditure and rebates are paid by industry collectively if the limit is exceeded. These limits may take the form of agreed growth rates for a specific period (e.g. 2014–2018 for branded medicines in the UK, via the Pharmaceutical Price Regulation Scheme [PPRS]), linking pharmaceutical expenditure growth rate to gross domestic product (GDP) growth rate (Spain), or allocating a maximum percentage of public healthcare expenditure (Italy). Other national-level agreements include mandatory discounts applied across a particular drug class (e.g. discounts applied to retail medicines in Germany) and product-specific confidential discounts that are negotiated with national payer agencies at the time of launch (e.g. the Italian Medicines Agency [AIFA] in Italy and the Ministry of Health in Spain). These national product-specific discounts also encompass more complex managed entry agreements (MEAs); these could be financial-based, such as most of the Patient Access Schemes used by the National Institute for Health and Care Excellence (NICE), the All Wales Medicines Strategy Group (AWMSG), and the Scottish Medicines Consortium (SMC) in the UK, or outcome-based agreements, such as the payment-by-results schemes used by AIFA in Italy.

At the local level, product-specific discounts are often negotiated by regional payer bodies, hospitals networks, and individual hospitals. Tenders, which are sometimes used at the national level, are commonly used at the local level and tend to apply to a specific part of the market, either high-usage products, hospital-only medicines, or generics dispensed in primary care [22, 23]. A significant part of the discounting takes place at the hospital level as a result of confidential contracting between companies and individual hospitals (or groups of hospitals).

At both national and local levels, discounts are usually confidential, especially for product-specific agreements. It is therefore not possible to adjust the list historical estimates or list forecast on a product-by-product basis. Alternative approaches were taken to estimate the impact of these discounts, depending upon the data available in each country.

Data with which to inform the adjustments were identified through two channels: (1) a review of peer-reviewed and grey literature, including government agency websites and reports, and (2) interviews with health economic experts in each of the countries to discuss data sources. Details on the data available and the specific adjustments made for each country are summarised in Table 2.

Wherever data were available, list-to-net adjustments were made specific to a particular type of discount. For example, in Italy, aggregate data were available on the rebates paid by industry at the national level due to exceeding the expenditure cap, rebates paid as a result of product-level MEAs, and net expenditure after discounts for both retail and hospital medicines.

In other countries, such as the UK, it was not possible to obtain data on specific forms of discounts (such as savings made as a result of Patient Access Schemes agreed with NICE, SMC, and AWMSG as they are confidential [24]). In these situations, the difference between list and net expenditure was estimated based on comparing historical aggregate net expenditure data from official sources with the historical list expenditure estimates from IQVIA. For the UK, this meant using the total net expenditure returns reported by the Department of Health as part of the PPRS agreement that controls pharmaceutical expenditure for most branded medicines in the UK. In Spain, where discount-specific savings were also not available, aggregate net expenditure data were obtained from reports from the Ministry of Finance and Public Administration.

To compare IQVIA historical list estimates with net data reported by governments, it was necessary to ensure that both estimates included the same types of expenditure (e.g. whether over-the-counter medicines were included) and costs (e.g. wholesaler or pharmacy margins). Where differences existed, we adjusted the IQVIA forecast accordingly. Notwithstanding, recognising the potential for discrepancies in the absolute aggregate estimate of expenditure, the focus of this analysis was on change in the size of the list-to-net gap over time (growth rate) rather than absolute estimates of expenditure. Thus, any form of discount that has remained flat in the past will not affect the growth rate of (net) pharmaceutical expenditure relative to list expenditure, and the adjustment is not included in the analysis. This would be a conservative assumption if those ‘flat’ discounts increase in the future.

2.4 Step 4: Net Forecast (2017–2021)

After the derivation of historical net estimates, the IQVIA list forecast model was re-run using the revised historical data to generate a new net forecast. As described in Step 2, the IQVIA list forecast comprises two main components: a projection forward based on historical trends combined with adjustments for expected ‘events’ (e.g. new product launches). The new net forecast reflected the revised historical data, while keeping unchanged the adjustments for expected events.

3 Results

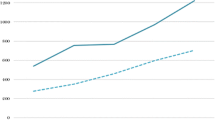

CAGRs are presented in Table 3 and Fig. 2.

The value of the adjustments (i.e. rebate, discounts) increases over time and in doing so also represents an increasing share of total (list) expenditure. For instant, for EU5 in aggregate, the estimated level of adjustments was €9 billion (representing 7% of total list pharmaceutical expenditure) in 2014. By 2021, the level is estimated at €27 billion, representing 17% of total list expenditure.

3.1 France

Historical list estimates of expenditure in France showed low average growth rates of 0.5% CAGR between 2010 and 2016. Historical net growth estimates were derived from French government returns (net of discounts), which were further adjusted to reflect rebates and payback agreements with manufacturers. Historical net data showed a small decline in pharmaceutical expenditure of − 0.4% CAGR over this period. The impact of including discounts is of nearly 1% point over the 7 years, which is significant.

Expenditure in the French retail sector fell with the implementation of cost-control methods, loss of exclusivity of major products and generic entry, and some shift towards hospital expenditure. Hospital expenditure is also largely controlled at the list price level, with growth remaining relatively slow despite the launch of high-budget-impact hepatitis C virus (HCV) products in recent years.

Health authorities in France actively manage aggregate pharmaceutical expenditure against annual targets and utilise payback agreements and price cuts to control growth. For example, paybacks by industry doubled from €520 million in 2014 to €1020 million in 2015 [25].

The list forecast for France was 1.8% CAGR between 2017 and 2021, which fell to 0.6% in the net forecast—an impact of over 1% point. By 2021, the level of discounting (as a result of manufacturers’ paybacks in the hospital sector) is estimated to represent 12% of total list pharmaceutical spend in that country, which is the lowest across the five countries. Given that the Comité Économique des Produits de Santé (CEPS) has publicly stated a target of €1 billion reduction in aggregate pharmaceutical expenditure in 2018, growth could in fact be lower than this [53].

3.2 Germany

The retail segment is dominant in Germany (86% of market), with many ‘hospital-type’ treatments delivered through office-based physicians (IQVIA data on file). According to the historical list estimates, total market and retail expenditure have both been growing historically at around 4% CAGR. Arzneimittelmarkt-Neuordnungsgesetz (AMNOG) rebates, which are publicly visible, are already captured in the historical list estimate and list forecast, but as more products become subject to them over time, the impact on total expenditure has increased (partly accounting for a lower list forecast growth rate of 3.2% compared with historical growth rate). Two mechanisms substantially reduce net expenditure estimates: the mandatory discounts applied to retail products and the sick fund clawbacks (rebates paid because of negotiated contractual agreements—noting that individual agreements are confidential, but the overall SHI impact is published yearly, which we have used in our analysis). The former (mandatory rebates) have fluctuated between 6 and 16% since 2010 [30]. The latter (clawback payments) increased threefold over 7 years, from €1310 million in 2010 to €3890 million in 2016 [28, 34].

Overall, the effect in Germany is to reduce the net forecast CAGR for 2017–2021 from 3.2 to 2.0%. By 2021, the level of discounting is estimated to represent 18% of total list pharmaceutical spend in that country, which is similar to the EU5 average. The effects of the mandatory discounts and the paybacks can be separated historically; the importance of the mandatory discount was higher than the payback system, although by 2015 its weight decreased to 60% of the total adjustment. For the forecast, the effect of both adjustments is aggregated, but the increase is driven by the increased SHI clawbacks, as mentioned.

3.3 Italy

Historical estimates of pharmaceutical expenditure in Italy from 2010 to 2016 were 4.5% (list) and 2.8% (net). Italian retail sector pharmaceutical sales have been falling since 2010, with overall market growth attributed to the hospital sector. This is due partly to a shift towards new product launches in specialty medicines and partly to the increasing role taken by hospitals in procuring medicines used outside of hospitals [54]. These medicines are distributed either directly by hospitals (e.g. new medicines for HCV) or by community pharmacies on behalf of hospitals (e.g. new oral antidiabetic medicines). The gap between list and net estimates increased from 2014 to 2016—at a time when both were growing faster than the historical trend—as a consequence of a sharp increase in savings related to deals agreed with manufacturers of HCV medicines.

The most important discounts in the Italian system that are not already captured in the historical list estimate (the historical list estimates include a 9.75% binding discount over list prices applied to all medicines, excluding the ‘innovative’ ones) are as follows:

-

1.

Industry-level payback based on level of hospital and outpatient pharmaceutical public expenditure as proportion of total health public expenditure; the actual payback was estimated at 1.6% of total gross expenditure for reimbursed medicines between 2013 and 2016 [55]. These apply to all class reimbursed medicines (orphan and innovative drug manufacturers are exempt from paying).Footnote 1

-

2.

Discounts negotiated with AIFA and at hospital level, which accounted for a list to-net difference of 8% of total public pharmaceutical expenditure on average in 2009–2016, increasing to 14.2% in 2016.

-

3.

Rebates from financial-based MEAs mainly for HCV medicines that averaged 4.3% of total pharmaceutical expenditure between 2015 and 2016, and outcome-based MEAs for cancer drugs medicines that averaged 0.3% (2014–2016).

Overall, the forecast CAGR for 2017–2021 reduced from 3.2% (list) to 1.1% (net); this is the biggest decrease in percentage points of the five countries. Indeed, by 2021, the level of discounting is estimated to represent 21% of total list pharmaceutical spend in that country, which is the highest across the five countries. Two adjustments were modelled: the discounts in hospital from managed entry agreements and industry-level payback, where total pharmaceutical expenditure caps are exceeded, which are expected to rise, and rebates for HCV medicines, which are expected to decline.

3.4 Spain

Historical list estimates of pharmaceutical expenditure growth in Spain were 2.2% CAGR between 2010 and 2016. However, growth declined between 2010 and 2014 and then increased on the back of expenditure on HCV medicines (between 2014 and 2016, growth at list prices was 9.4%).

Retail sector sales have been falling since 2010 in Spain, with most growth attributed to the hospital sector due to oncology costs and short-term expenditure on HCV medicines (Spain has particularly high HCV prevalence). In the retail setting, compulsory paybacks came in force in 2006 (Law 29/2006) [56]. The pharmaceutical industry pays money back every 4 months to research institutes (via the Institute Carlos III) and to the government to fund policies encouraging healthcare cohesion across Spain and education programmes for healthcare professionals, among others, expressed as a percentage of sales [57]. Such payments are not captured in the historical list estimates, although, as they have remained flat (1.5–2%) since their introduction in 2006, they do not contribute to any divergence in the list and net forecast.

Mandatory discounts applied to invoices for all hospital medicines (7.5%; 4% for orphan medicines) have been in place since 2010 [56]. Increasing use of hospital products means these savings are forecasted to increase. In addition, a dual pricing system is in place for hospital medicines: the list price (‘precio notificado’)—which is the official price for international price referencing—and the reimbursed price (‘precio facturación’). The list price is published, but the reimbursement price is confidential.

Historical net expenditure data for hospital sales were available from 2014 to 2016 (during this period, HCV medicines were launched in Spain). These data are published by the Ministry of Finance,Footnote 2 and the difference between net expenditure on hospital medicines versus aggregate expenditure at list prices was 22%, 28%, and 34% for 2014, 2015, and 2016, respectively [58]. The Ministry of Finance also publishes net expenditure in primary care, but we did not compare this data with IQVIA’s as we felt IQVIA data captured an important part of the discounts.

In 2015, a Stability Pact was signed between the Ministry of Health and the research-based pharmaceutical trade association, Farmaindustria, on behalf of industry [58]. This pact links pharmaceutical expenditure growth to GDP growth; over and above this level of growth, the industry is required to pay back the difference. These limits have not been reached since their introduction because pharmaceutical expenditure growth fell below GDP growth over this period [58]. However, this legislation could act as an upper limit on future growth.

After adjusting the historical list estimate for the observed difference with the Ministry of Finance net data for hospital pharmaceutical expenditures, the net forecast for 2017–2021 was 1.1 versus 2.5% under the list forecast. By 2021, the level of discounting is estimated to represent 20% of total list pharmaceutical spend in Spain, where the difference in this case is due to the discounts in the hospital sector, estimated as the gap between list and net expenditure.

3.5 UK

In the UK, the historical list estimate of expenditure growth was 6.8% CAGR between 2010 and 2016. At the time of data analysis, publicly available historical net expenditure data were available from 2013 to 2017 and only included the 51% of the UK drug market covered by the PPRS [48,49,50,51,52]. The PPRS is estimated to cover 80% of branded medicines by value. No adjustments were made to account for confidential discounts and rebates in the non-PPRS market, which includes generics and HCV expenditure on products marketed by Gilead (which, as of December 2017, was not a member of the PPRS). Given that these products are likely to be subject to discounts of a similar magnitude to PPRS products, the adjustment in the UK is likely to be under-representative of the true list-to-net difference and to overestimate growth rates. We are aware there is a pharmacy clawback based on rebates from manufacturers/wholesalers; this has been constant under the historic period so would not affect the growth rate.Footnote 3 This clawback is not modelled.

The unadjusted forecast is 3.8% CAGR for the period 2017–2021; the net forecast decreases to 2.3%. By 2021, the level of discounting is estimated to represent 17% of total list pharmaceutical spend in that country, which is equal to the EU5 average—as mentioned, there is only one adjustment for the UK (PPRS net sales after rebates).

3.6 EU5

When the forecasts for the five countries are aggregated, the EU5 (unweighted) average historical growth rate falls from 3.4% at list to 2.5% at net. For the forecast, the net growth rate is estimated at 1.5% CAGR versus 2.9% at list.

3.7 Some Sensitivity Analysis: Impact of Biosimilars

We did not undertake sensitivity analyses, although we illustrate with the case of biosimilars the sort of analyses that could be done. We pick biosimilars given the number and size of biologics that will lose patent protection in the coming years, as the evolution of the market for biosimilars will be an important variable impacting future expenditure growth rates [59]. Three key variables affect biosimilar impact: speed of entry, uptake, and degree of price competition (linked to the number of biosimilars, but also with originators). The assumption in the IQVIA list forecast is that the size of price reductions at the point of loss of exclusivity in future will be of the same magnitude as those observed historically since the introduction of biosimilars. This could be an underestimate of future biologic value erosion, as the biosimilar market is still developing, and greater competition is expected as it matures. Across the EU5 countries, €30–40 billion of cumulative sales can be exposed to biosimilar competition through 2021 (IQVIA data on file). If biosimilars lead to value erosion that is closer to that seen for small molecules, overall future net growth rates in the EU5 based on this analysis would be nearer to 0.5–1% over the next 5 years, rather than the 1.5%. However, this will depend on greater uptake of biosimilars than currently seen through educational and other activities, including the collection of high-quality comprehensive outcomes data on the effectiveness and safety of biosimilars and originator products [59,60,61].

4 Discussion

The results from this study suggest that future growth in pharmaceutical expenditure in Europe is likely to be lower than previously understood from forecasts based on list prices. The growth in use of confidential discounts over the last decade (such as those badged as patient access schemes, e.g. those in the UK and those agreed locally or regionally), especially for cancer medicines, which are usually used in the hospital setting (e.g. see Pauwels et al. [13]), has led to increased divergence between list and net prices, with the associated overstatement of historical expenditure levels. One possible reason for this is the increased use of external reference pricing, where prices across countries are interdependent; thus, there are incentives to keep these discounts confidential. However, this way of regulating medicines prices was recently criticised because of its negative effects [62]. Another factor that can impact the size of the rebates are ‘product events’. For example, in the period 2015 and 2016, the new generation of HCV medicines were introduced and, in some markets (such as Italy), were sold with very substantial rebates that momentarily boosted the rebate and created an unreliable trend. However, industry-level payback because of drug budget overrun is expected to increase, and, incorporating this effect, the divergent trend of list and net expenditure is expected to be confirmed. It is also possible, but maybe less so, that rebates/adjustments would decrease over time and, thus, net expenditure growth would be higher than list expenditure.

The historical and forecast net-price adjustments presented in this paper reflect that divergence as closely as the publicly available data allow, but the confidential nature of these arrangements mean they are inherently difficult to quantify. Not all confidential discounts or rebates have been captured for every country. For example, in the UK, net data were only available for approximately half of the UK market by value (medicines covered by PPRS). This analysis also relied upon published net expenditure data reported at the national level. Rebates paid to hospitals and regional health authorities are not fully captured in all countries. This is certainly the main limitation of the paper; however, we are not aware of any other sources that will fill the existing information gaps on the level of discounting. One possible further avenue could be to undertake (confidential) surveys/interviews with various payers in these countries, or with pharmaceutical companies. Interaction with payers could also be used to validate our results. Moreover, unknown rebates have been assumed constant and thus do not impact the growth rate; however, they would have impacted the net value.

This analysis was based on an IQVIA forecast, which is considered one of the most established analyses of pharmaceutical expenditure and benefits from the comprehensive country-specific data collected by IQVIA. However, as with all modelling exercises, the IQVIA forecasting methodology incorporates assumptions about future events—such as new drug launches and socioeconomic developments—that are fundamentally uncertain. Nevertheless, knowing the current research and development pipeline of potential new medicines and the loss of exclusivity dates of existing medicines provides as accurate an estimate as possible of how medicines expenditure may change in the future. The adjustments to the IQVIA forecast for future years were estimated based on the trend in differences between list and net observed historically; if the level of discounts and rebates changes in future, this prediction may not be accurate. Future research could undertake sensitivity analyses to understand the impact of various events on both the expected growth rate and the increased/decreased divergence between list and net expenditure.

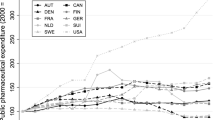

No other European net price forecasts were identified that could be used to validate the future estimates from this analysis. However, the historical adjustments can be compared with OECD data (Fig. 3), which shows net pharmaceutical expenditure as flat or falling as a proportion of healthcare expenditure in EU5 countries between 2010 and 2018 (most recent data available) [3]. These data provide some context to our results, but the differences between IQVIA and OECD data should be noted. Broadly speaking, these are that (1) OECD numbers are at sell-out price and IQVIA at ex-manufacturing price (the differences are wholesaler and pharmacy margins and dispensing fees); (2) OECD numbers can capture patient co-payments as part of expenditure, but these are not included for IQVIA expenditure; (3) OECD numbers are based on country reporting, and countries, for different reasons, might not always follow the OECD guidelines, which means the numbers may be over- or understated; and (4) hospital data are incomplete for some countries.

In the USA, a similar analysis was performed to explore the impact of discounts on total expenditure [63]. This study estimated that, between 2005 and 2012, manufacturers’ discounts and rebates reduced expenditure on branded medicines by approximately 18% each year. However, between 2010 and 2014, the discounts and rebates increased from 18 to 28% of total expenditure on brand-name medicines. This growing divergence between list and net prices in the USA reflects the similar trend we observed in Europe. Unlike our own study, Aitken et al. [63] did not forecast the implications for future pharmaceutical expenditure growth in the USA.

It is beyond the scope of our study to explore the drivers of growth in pharmaceutical expenditure, as this is a complex issue. However, we can observe mixed positive and negative effects. On one hand, prescribed volumes for medicines to treat non-communicable diseases, such as diabetes, hypercholesterolaemia, hypertension, and acid-related stomach disorders, have appreciably increased in recent years, with volumes rising several-fold among countries [64,65,66]. For instance, and according to AIFA estimates, most of the increase of the pharmaceutical retail market is due to an increase in volumes [67]. This is coupled with a shift towards more expensive medicines in the hospital setting as new innovative medicines are launched in areas of high unmet need. On the other hand, and as mentioned in Sect. 1, cheaper generics in many large therapeutic areas have entered the market, generating significant savings to third-party payers (i.e. see European Assessment [68]). As mentioned, one area with more uncertainty is the impact of biosimilars in the future.

Aitken [69] analysed the evolution of pharmaceutical expenditure in five countries, including France, Germany, and the UK, over 20 years. Among other things, he showed that pharmaceutical expenditure growth has been roughly in line with increases in total health expenditure. Indeed, our projections, after taking into account adjustments, are below predicted healthcare expenditure growth in Europe and in line with long-term economic growth rates [70, 71]. Understanding the dynamics of the market in the past is always an important element in driving the forecasts. For policy makers concerned about the sustainability of pharmaceutical expenditure, this study may provide some comfort, in that the perceived problem is not as large as expected. While there is debate to be had about the merits of non-transparent discounts and rebates, they appear to be playing an important role in containing the growth of real pharmaceutical expenditure whilst allowing reimbursement and funding for new medicines that would not have been possible without such schemes. The results of this analysis suggest that healthcare payers maintain considerable control over pharmaceutical expenditure and have been effective in managing growth historically. Even the introduction of new HCV medicines, which prompted a very public debate about pharmaceutical expenditure sustainability [72, 73], appear to have led to only a temporary uptick in the growth rate, mitigated by negotiated discounts and rebates (especially as a result of competition between different medicines), after which the growth trajectory quickly reverted to the historical average.

5 Conclusion

The increasing frequency and magnitude of confidential discounts, including MEAs, rebates, and discounts, have led to a growing divergence between list and net prices for medicines in Europe. This is driven by increasing financial pressures within health systems, policies such as external reference pricing, and a shift in pharmaceutical innovation from retail to hospital settings with most new medicines for immunological and cancer conditions in many countries. It is beyond the remit of our article to compare the expenditure in pharmaceuticals with the outcomes achieved from their use, as this is a complex task.

After adjusting for discounts and rebates, net expenditure growth in EU5 is predicted to be approximately 1.5% CAGR over the next 5 years. This is below predicted healthcare expenditure growth in Europe and in line with long-term economic growth rates.

Notes

Regulation of spending caps on drugs has changed many times. In 2001 (law n. 405/2001), a spending cap on drugs used outside hospitals, named ‘Spesa farmaceutica territoriale’ (retail sector and drugs procured by hospitals and used outside hospitals) was introduced. The spending cap was set at 13% of overall public health expenditure. This legislation was amended in 2008 (law n. 222/2007): the spending cap on Spesa farmaceutica territoriale (including patient co-payments set at regional level) was determined as the 14.0% ceiling of the overall public health expenditure at both national and regional levels, whereas the hospital (in-patient) budget for pharmaceutical expenditure (named ‘Spesa farmaceutica ospedaliera’) could not exceed a 2.40% ceiling of the overall public health expenditure. If the budget of the Spesa farmaceutica territoriale was overrun, the industry and the distribution would have been required to cover the full deficit. Since 2013 (law n. 135/2012), the industry was asked to cover 50% of the Spesa farmaceutica ospedaliera budget deficit (the budget was raised to 3% of overall public health expenditure, whereas the budget for the Spesa farmaceutica territoriale was lowered to 11.35%). The spending caps have changed again since 2017, set as 7.96 and 6.89% of the overall public health expenditure for retail drugs and all drugs procured by hospitals, respectively.

In December 2017, the Spanish Ministry of Health started publishing net costs of medicines used in public hospitals, including discounts. However, the two datasets do not coincide, and differences are especially big for Valencia and Catalonia (https://www.diariofarma.com/2017/12/04/comparable-gasto-hospitalario-publica-sanidad-hacienda). The main reason behind the differences is they are measuring two different things and are thus not comparable. Our analysis uses the Ministry of Finance data, and it is beyond the scope of this paper to analyse the differences between the two different datasets.

We thank one of the reviewers for pointing this out.

References

Newhouse JP. Medical care costs: how much welfare loss? J Econ Perspect. 1992;6:3–21.

Drummond M, Jonsson B. Moving beyond the drug budget silo mentality in Europe. Value Health. 2003. https://doi.org/10.1046/j.1524-4733.6.s1.8.x/full.

OECD. Pharmaceutical spending (indicator). 2018. https://doi.org/10.1787/998febf6-en. Accessed 5 Jul 2018.

OECD. Ensuring health system sustainability and access to innovation. http://www.oecd.org/health/health-systems/Ensuring-health-system-sustainability-and-access-to-innovation.pdf. Accessed 1 Aug 2018.

OECD. Pharmaceuticals. http://www.oecd.org/els/health-systems/pharmaceuticals.htm. Accessed 1 Aug 2018.

Wettermark B, Persson ME, Wilking N, Kalin M, Korkmaz S, Hjemdahl P, et al. Forecasting drug utilization and expenditure in a metropolitan health region. BMC Health Serv Res. 2010;10:128.

Eriksson I, Wettermark B, Persson M, Edstrom M, Godman B, Lindhe A, et al. The early awareness and alert system in Sweden: history and current status. Front Pharmacol. 2017;8:674.

Godman B, Joppi R, Bennie M, Jan S, Wettermark B. Managed introduction of new drugs. Chapter 20: 210–221. In: Elseviers M, Wettermark B, et al., editors. Drug utilization research: methods and applications. Chichester: Wiley; 2016. ISBN 978-1-118-94978-8.

Schlander M, Dintsios C-M, Gandjour A. Budgetary impact and cost drivers of drugs for rare and ultrarare diseases. Value Health. 2018;21(5):525–31.

IQVIA. Understanding the dynamics of drug expenditure. https://www.iqvia.com/institute/reports/understanding-the-dynamics-of-drug-expenditure-shares-levels-compositions-and-drivers. Accessed 1 Aug 2018.

QuintilesIMS Institute Forecast. QuintilesIMS Institute Forecast: global drug market will reach nearly $1.5 trillion in 2021 as spending growth moderates. https://www.iqvia.com/newsroom/2016/quintilesims-institute-forecast. Accessed 1 Aug 2018.

Ferrario A, Arāja D, Bochenek T, Čatić T, Dankó D, Dimitrova M, et al. The implementation of managed entry agreements in Central and Eastern Europe: findings and implications. PharmacoEconomics. 2017;35(12):1271–85.

Pauwels K, Huys I, Casteels M, De Nys K, Simoens S. Market access of cancer drugs in European countries: improving resource allocation. Target Oncol. 2014;9(2):95–110.

Vogler S, Paris V, Ferrario A, Wirtz VJ, de Joncheere K, Schneider P, et al. How can pricing and reimbursement policies improve affordable access to medicines? Lessons learned from European countries. Appl Health Econ Health Policy. 2017;15(3):307–21.

Morgan S, Vogler S, Wagner A. Payers’ experiences with confidential pharmaceutical pricediscounts: a survey of public and statutory health systems in North America, Europe, and Australasia. Health Policy. 2017;121:354–62.

Espin J, Rovira J, Olry de Labry A. Review series on pharmaceutical pricing policies and interventions: working paper 1: external reference pricing. WHO/HAI Policy Review. 2011.

Jommi C. Managed entry agreements and high cost medicines (European perspective). In: Babar Zaheer-Ud-Din, editor. Equitable access to high-cost pharmaceuticals. London: Springer; 2018.

Adamski J, Godman B, Ofierska-Sujkowska G, et al. Risk sharing arrangements for pharmaceuticals: potential considerations and recommendations for European payers. BMC Health Serv Res. 2010;10:153.

Pauwels K, Huys I, Vogler S, Casteels M, Simoens S. Managed entry agreements for oncology drugs: lessons from the european experience to inform the future. Front Pharmacol. 2017;8:171. https://doi.org/10.3389/fphar.2017.00171.

Clopes A, Gasol M, Cajal R, Segú L, Crespo R, et al. Financial consequences of a payment-by-results scheme in Catalonia: gefitinib in advanced EGFR-mutation positive non-small-cell lung cancer. J Med Econ. 2017;20(1):1–7.

Quintiles IMS Institute. Outlook for global medicines through 2021. Balancing cost and value. https://morningconsult.com/wp-content/uploads/2016/12/QuintilesIMS-Institute-Global-Outlook-FINAL.pdf. Accessed 1 Aug 2018.

Kanavos P, Seeley L, Vandoros S. Tender systems for outpatient pharmaceuticals in the European Union: evidence from the Netherlands, Germany and Belgium. LSE Health London School of Economics. 2009.

Espin J, Rovira J, Calleja A, et al. How can voluntary cross-border collaboration in public procurement improve access to health technologies in Europe? Health systems and policy analysis, policy brief no. 21. 2016.

National Institute for Health and Care Excellence. List of recommended technologies that include a commercial arrangement. Undated. https://www.nice.org.uk/About/What-we-do/Patient-access-schemes-liaison-unit/List-of-technologies-with-approved-Patient-Access-Schemes. Accessed 1 Aug 2018.

OOECD. Health at a glance 2017: OECD indicators. Paris: OECD Publishing; 2017. https://doi.org/10.1787/health_glance-2017-en.

Comite economique des produits de sante. French Healthcare Products Pricing Committee. http://solidarites-sante.gouv.fr/ministere/acteurs/instances-rattachees/article/rapports-d-activite-du-ceps. Accessed 1 Aug 2018.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2008. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2008.

Schwabe U, Paffrath D. Arzneiverordnungs—report. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2009.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2010. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2010.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2011. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2011.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2012. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2012.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2013. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2013.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2014. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2014.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2015. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2015.

Schwabe U, Paffrath D. Arzneiverordnungs—report 2016. Aktuelle Daten, Kosten, Trends und Kommentare. Berlin: Springer; 2016.

Busse R, Blumel M. Germany: health system review. Health Syst Transit. 2014;16:1–296.

AIFA (Agenzia Italiana del Farmaco). Osservatorio Nazionale sull’impiego dei Medicinali in Italia. L’uso dei farmaci in Italia. Rapporto nazionale anno 2010, Rome. 2011.

AIFA (Agenzia Italiana del Farmaco). Osservatorio Nazionale sull’impiego dei Medicinali in Italia: L’uso dei farmaci in italia. Rapporto nazionale anno 2011, Rome. 2012.

AIFA (Agenzia Italiana del Farmaco). Osservatorio Nazionale sull’impiego dei Medicinali in Italia: L’uso del farmaci in italia. Rapporto nazionale anno 2012, Rome. 2013.

AIFA (Agenzia Italiana del Farmaco): Osservatorio Nazionale sull’impiego dei Medicinali in Italia: L’uso del farmaci in italia. Rapporto nazionale anno 2013, Rome. 2014.

AIFA (Agenzia Italiana del Farmaco). Osservatorio Nazionale sull’impiego dei Medicinali in Italia: L’uso del farmaci in italia. Rapporto nazionale anno 2014, Rome. 2015.

AIFA (Agenzia Italiana del Farmaco). Osservatorio Nazionale sull’impiego dei Medicinali in Italia: L’uso del farmaci in italia. Rapporto nazionale anno 2015, Rome. 2016.

AIFA (Agenzia Italiana del Farmaco). Osservatorio Nazionale sull’impiego dei Medicinali in Italia: L’uso del farmaci in italia. Rapporto nazionale anno 2016, Rome. 2017.

Determinazione 1406/2016 e importi definitivi di cui all’art. 21, comma 8 d.l. n. 113/2016; 2016. http://www.agenziafarmaco.gov.it/content/determinazione-14062016-e-importi-definitivi-di-cui-all%E2%80%99art-21-comma-8-dl-n-1132016-21102016. Accessed 1 Aug 2018.

Agenzia Italiana del Farmaco. Monitoraggio della spesa farmaceutica regionale. http://www.agenziafarmaco.gov.it/content/monitoraggio-spesa-farmaceutica. Accessed 1 Aug 2018.

Ministero de Hacienda y Funcion Publica. Indicadores sobre gasto farmaceutico y sanitario. http://www.minhap.gob.es/Documentacion/Publico/CDI/Gasto%20Sanitario/SERIE%20Gasto%20Farmac%C3%A9utico%20y%20Sanitario.xls. Accessed 1 Aug 2018.

Legislacion consolidada. Ley 29/2006, de 26 de julio, de garantías y uso racional de los medicamentos y productos sanitarios. Jef. del Estado « BOE » ; 2006. p.178.

Department of Health. 2014 Pharmaceutical Price Regulation Scheme (PPRS). Aggregate Net Sales and Payment Information. 2014. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/385850/2014_PPRS_Q1_Data_june_2014.pdf. Accessed 1 Aug 2018.

Department of Health. Annual report and accounts 2013–14 (for the period ended 31 March 2014). 2014.

Department of Health. Annual report and accounts 2014–2015 (for the period ended 31 March 2015). 2015.

Department of Health. Annual report and accounts 2015–2016 (for the period ended 31 March 2016). 2016.

Department of Health. Annual report and accounts 2016–2017 (for the period ended 31 March 2017). 2017.

The Social Security Financing Law (“Loi de financement de la sécurité sociale” or LFSS), of the official journal, annex 7, December 31, 2017.

Jommi C, Minghetti P. Pharmaceutical pricing policies in Italy. In: Babar ZUD, editor. Pharmaceutical prices in the 21st century. London: Springer; 2015. p. 131–51.

Authors own elaboration, based on data published on the Determina AIFA 1406 (20 Ottobre 2016).

Real Decreto-ley 8/2010, de 20 de mayo, por el que se adoptan medidas extraordinarias para la reducción del déficit público. Boletin Oficial del Estado. Num 126. Sec. I. pp. 45070–45128.

http://www.minhafp.gob.es/es-ES/Prensa/En%20Portada/2017/Paginas/GOBIERNO_FARMAINDUSTRIA.aspx. Accessed 1 Aug 2018.

Farmaindustria y Gobierno firman estabilidad económica y de acceso. 2015. https://www.diariofarma.com/2015/11/04/farmaindustria-y-gobierno-acuerdan-estabilidad-economica-y-de-acceso. Accessed 1 Aug 2018.

Rovira J, Espin J, Garcia L, Olry de Labry A. The impact of biosimilars’ entry in the EU market (European Medicines Information Network—EMINET—2011). DG Enterprise and Industry. European Commission.

Moorkens E, Vulto AG, Huys I, Dylst P, Godman B, Keuerleber S, et al. Policies for biosimilar uptake in Europe: an overview. PloS One. 2017;12(12):e0190147.

Mestre-Ferrandiz J, Towse A, Berdud M. Biosimilars: how can payers get long-term savings? Pharmacoeconomics. 2016;34:609–16.

Persson U, Jönsson B. The end of the international reference pricing system? Appl Health Econ Health Policy. 2015. https://doi.org/10.1007/s40258-015-0182-5.

Aitken M, Berndt ER, Cutler D, Kleinrock M, Maini L. Has the era of slow growth for prescription drug spending ended? Health Aff. 2016;35:1595–603. https://doi.org/10.1377/hlthaff.2015.1636.

Bennie M, Godman B, Bishop I, Campbell S. Multiple initiatives continue to enhance the prescribing efficiency for the proton pump inhibitors and statins in Scotland. Expert Rev Pharmacoecon Outcomes Res. 2012;12(1):125–30.

Godman B, Wettermark B, van Woerkom M, Fraeyman J, Alvarez-Madrazo S, Berg C, et al. Multiple policies to enhance prescribing efficiency for established medicines in Europe with a particular focus on demand-side measures: findings and future implications. Front Pharmacol. 2014;5:106.

Woerkom M, Piepenbrink H, Godman B, Metz J, Campbell S, Bennie M, et al. Ongoing measures to enhance the efficiency of prescribing of proton pump inhibitors and statins in The Netherlands: influence and future implications. J Comp Eff Res. 2012;1(6):527–38.

AIFA (Osservatorio sull’impiego dei medicinali). L’uso dei farmaci in Italia, Anno 2015. http://www.aifa.gov.it/sites/default/files/Rapporto_OsMed_2015__AIFA.pdf. Accessed 1 Aug 2018.

European Assessment. Impact assessment accompanying the document proposal for a regulation of the European parliament and of the council amending regulation (EC) no 469/2009 concerning the supplementary protection certificate for medicinal products. 2008. https://ec.europa.eu/docsroom/documents/29463. Accessed 1 Aug 2018.

Aitken M. Understanding the dynamics of drug expenditure. Shares, levels, compositions and drivers. QuintilesIMS Institute. 100 IMS Drive, Parsippany, NJ 07054, USA. 2017.

International Monetary Fund. Real GDP growth. Annual percentage change. http://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/EUQ. Accessed 1 Aug 2018.

OECD. “What Future for Health Spending?”. OECD Economics Department Policy Notes, No. 19. 2013. https://www.oecd.org/economy/health-spending.pdf. Accessed 1 Aug 2018.

Brennan T, Shrank W. New expensive treatments for hepatitis C infection. JAMA. 2014;312(6):593–4.

de Bruijn W, Ibanez C, Frisk P, Bak Pedersen H, Alkan A, Vella Bonanno P, et al. Introduction and utilization of high priced HCV medicines across Europe; implications for the future. Front Pharmacol. 2016;7:197.

Author information

Authors and Affiliations

Contributions

AH and AP conceived of and designed the paper and collected the data. All authors were involved in writing or critical review of the paper, with important intellectual contributions and collection of some information, and approved the final version of the article for submission. JM-F acts as guarantor that all aspects that make up the manuscript have been reviewed, discussed, and agreed among the authors in order to be exposed with maximum precision and integrity.

Corresponding author

Ethics declarations

Data availability statement

The datasets generated during and/or analysed during the current study are not publicly available because they are owned by a third party (IQVIA). Aggregated data might be available from the corresponding author on reasonable request. The data we used on the level of rebates and discounts are available publicly (see references in text).

Conflict of interest

JE, MS, BG, PA, CJ have received an honorarium from Celgene International for attending an advisory meeting. JM-F received an honorarium from Celgene International for attending an advisory meeting and to support the writing of the paper. SF and AP are employees of Celgene International. AH is employed by Dolon Ltd, a consultancy that provides services to pharmaceutical companies, including Celgene International. All authors have no conflicts of interest that are directly relevant to the content of this article.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 International License (http://creativecommons.org/licenses/by-nc/4.0/), which permits any noncommercial use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Espin, J., Schlander, M., Godman, B. et al. Projecting Pharmaceutical Expenditure in EU5 to 2021: Adjusting for the Impact of Discounts and Rebates. Appl Health Econ Health Policy 16, 803–817 (2018). https://doi.org/10.1007/s40258-018-0419-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40258-018-0419-1